Raleigh’s had a housing boom during the last ten years. The 2010 Census data shows the city’s housing units increased an incredible 45.9 percent since 2000.

Although today’s nationwide housing market is impacted by foreclosures and a lack of affordable options for those with limited incomes, Raleigh has fared better than other cities through the economic downturn.

Experts say that growth will continue and while rents will increase, plenty of options remain for median incomes.

Affordability

As of 2009, the median income in the Raleigh-Cary area was $76,900 and the median income for Wake County was $63,770, with 10.2 percent of the county population below the poverty level.

According to the National Association of Realtors, the median home price for Raleigh in the first quarter of 2011 was $229,900, compared to the United States median price of $158,700.

The N.C. Housing Coalition found 39 percent of renters in the Raleigh-Cary area are unable to afford rent on a two-bedroom apartment at the fair market rent established by the federal Department of Housing and Urban Development for the region. Households earning minimum wage in 2009 could only afford $341 in rental payments — almost $300 less than the fair market rent.

But Raleigh rents are going up, according to the Triangle Area Residential Realty Report. Average rents from January through May 2011 were 11 percent higher than the same period in 2010. The area’s two month supply of rentals is considered low and rent prices are expected to rise until supplies stabilizes.

But Raleigh rents are going up, according to the Triangle Area Residential Realty Report. Average rents from January through May 2011 were 11 percent higher than the same period in 2010. The area’s two month supply of rentals is considered low and rent prices are expected to rise until supplies stabilizes.

HUD’s definition of affordable housing is housing that costs no more than 30 percent of a household’s income. For this definition, housing costs include not only rent or mortgage but utilities, and for homeowners they include taxes and insurance as well, said Margaret Matrone, director of government relations and communications of the N.C. Housing Finance Agency.

More affordable options may soon be available, though. Linda Trevor, president of the Raleigh Regional Association of Realtors, noted, “Builders that originally planned to target higher incomes have changed their plans to create homes that are more attractive to the general buyer right now.”

She said Raleigh’s market is affected by harder hit markets across the nation.

“I know of several households across the country that would move here in an instant, but they are waiting for their homes to sell,” she said. “Once markets improve elsewhere, we’ll see an increase locally.”

Vacant Housing

The new Census shows the number of vacant homes rose from 6.7 percent to 7.5 percent, compared to a national average of 11.4 percent.

Part of the vacancy can be attributed to foreclosures, although foreclosures on homes in North Carolina fell 38.3 percent in May from a year ago and were down 3.4 percent from April, according to RealtyTrac.

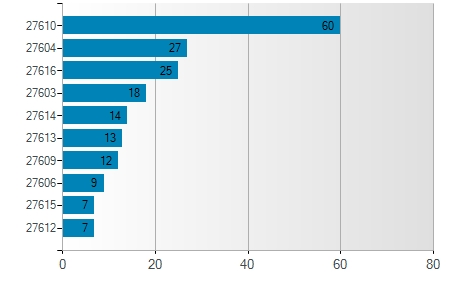

That means one in every 1,050 homes in Raleigh has received a foreclosure filing in May 2011. Statewide, one in every 1,584 homes had foreclosure activity, but compared to the nation, the state ranks in the medium to low range. Raleigh’s top five zip codes for foreclosures are 27610, 27604, 27616, 27603 and 27614.

Foreclosures are down though. In Wake County, foreclosure starts from March to May of 2011 totaled 1,154, which is 20 percent lower compared to the same period last year.

The amount of vacant rental housing is usually higher in Raleigh than in Wake County or the Raleigh-Cary area, according to the City of Raleigh Consolidated Plan 2010-2015. The reason is the high number of students attending Raleigh’s many colleges and universities.

Single-family detached homes still account for almost half of the Raleigh’s housing units, though, according to the 2008 American Community Survey.

Options

Cash buyers are being seen more frequently as investors snap up properties at lower rates, according to several Raleigh realtors, but for those with more modest means other options exist.

If you make less than 50 percent of the Area Median Income (i.e. $27,200 for a household of one or $38,850 for a household of four) the City of Raleigh’s Affordable Housing Program may present options for rental property. Home buyer and home repair options are also available, including the Citywide Home Ownership Program.

Shawn McNamara, program manager of the Raleigh Community Development Department, sees Raleigh as a special case. Even though there have been cuts in community development block grants and a drop in HUD’s home investment partnership funding, the city itself invests in affordable housing.

Raleigh’s last affordable housing bond was approved in 2005 and is in its last year of funding, but the council plans to put a $16 million affordable housing bond on the ballot this fall.

According to McNamara, “Not every city does affordable housing bonds but Raleigh has done three: in 1990, 2000 and 2005. Our city council supports them and the voters have approved them, which I think speaks pretty well of Raleigh.”