The long-gestating student apartment complex proposed for Hillsborough Street across from the bell tower has at long last been approved by City Council.

Following a pretty heated debate between veteran and freshman Councilors the vote was once again 5-3 in favor of allowing the project to move forward. Because of the split vote, Councilors had to take a second vote to approve the project.

Some Councilors, most notably Thomas Crowder, warned that by allowing the development to skirt the Future Land Use Map guidelines for a five-story maximum, the seven-story project could set a dangerous precedent that may open the city up to future lawsuits, derail plans to reach the city’s comprehensive planning goals, and bring about the fall of the great Raleigh empire.

While much of the discussion was covered in the article linked above, and here, from when it first came before the planning commission, or here when there was a public hearing… there were a few moments from Tuesday’s discussion that were left out of previous coverage.

When introducing the case, Z-2-14, Mayor McFarlane accidentally referred to it as Z-2-12.

“I’m sorry, it just feels like it’s been two years,” she quipped. Couldn’t agree more, Mayor.

Later on, an increasingly fed-up Councilor Crowder directly called to task two of his colleagues. Odom, he said, who was in favor of the development, was being inconsistent, as Odom had voted against the seven-story rail station project a year earlier because it didn’t mesh with the Comprehensive Plan.

He then requested that Maiorano, who had been vocal in his support of the project, state what kind of public benefit it would actually serve.

“For the record, we need to state what the public benefit is,” he explained, chidingly.

Councilor Stephenson also spoke against Maiorano, referring to him as a “newcomer” who hadn’t had as much time to see how the comprehensive plan works as the other Councilors.

Coming Soon

Permits were issued last week for $50,000 worth of work at the exercise studio CrossFit Goliath, located at 5621 Venture Drive in north Raleigh. In addition to the standard CrossFit workouts, such as high-intensity interval training, Olympic weightlifting and plyometrics, the facility’s owner, a champion from Gath who stands at an impressive height of six cubits and a span, also offers courses in slingshot defense and why, generally, it’s not a good idea to defy the armies of the living God.

Speaking of the Almighty, He should be pleased to learn that He is being glorified not only through the construction of the brand-new Holy Trinity Anglican Church on Peace Street, but also by the extensive renovations scheduled to take place at the Raleigh First Assembly of God on Yonkers Road.

The new, 24,294 square-foot church is being built at a cost of $5,562,609 by Clancy and Theys, the company that constructed the massive steel-framed globe on West Jones Street, which unfortunately took more than seven days to create.

The renovations at First Assembly are even more costly, with a total listed price of $5,746,156. At these rates, it might be time to re-think the whole “no money-changers in the temple” rule.

Miracles of a more mundane, medical variety will soon be on tap at the new 3-story, 17,997 square-foot building scheduled for construction on the campus of the Duke Raleigh Hospital off of Wake Forest Road. Permits for phases 2-5 of the project were issued last week to Lend Lease Construction, for a total cost of $2,858,193. Fortunately most modern hospitals have entire wings set-aside for the money-changers, so coming up with the cash was likely of little concern for Duke.

James Borden / Raleigh Public Record

A new Family Dollar, one of those awful places where many items actually cost more than a dollar, is getting a new location on Rock Quarry Road in southeast Raleigh. The 8,320-square-foot store will be built at a cost of about $400,000 by Charlotte firm Southeastern Utility Construction. As the store’s address is just outside the Beltline, ITB snobs won’t have to fret over which they hate more – the low-end Family Dollar chain, or a construction company from the Queen City.

The new Chuck & Buck’s Cones & Cups, set to be built at the Mini City Shopping Center on Capital Boulevard, will force us OTB heathens to make a different kind of choice – chiefly, whether the store’s name or its featured product is more awesome. For the record, it would have to the best ice cream this side of Goodberry’s in order for the product to beat that amazing, lyrical name. And while “cup” doesn’t exactly rhyme with “Buck” – it’s close enough.

By The Numbers

Welcome to third edition of By the Numbers, where we take a look at the past month’s issued construction permits and real-estate transaction records. As tempting as it is, it’s a little early to repeat the Barbie joke from the first edition, so let’s just say math is confusing and that there’s a slight chance of error, especially when compiling the real-estate records, which often contain duplicates. Any suggestions for a better way of doing this are more than welcome; just be sure to add the word “Trash” to your subject line so that Gmail can filter it accordingly. But seriously, send ideas and math corrections my way.

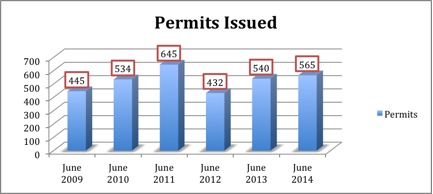

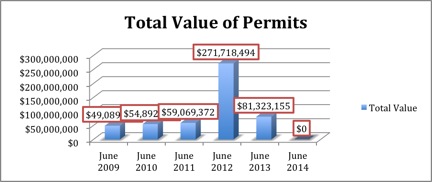

A total of 565 residential and non-residential construction permits were issued between June 1 and June 28, with the projects reaching a total cost of $100,599,344. The most expensive among them was the aforementioned First Assembly Church renovations; the least was for $500 worth of “hotwire communications” at the Chapel Hill Road condominiums. In comparison to the past five years, June 2014 had the second-most number of projects to 2011’s 645, with a total cost second only to 2012’s $271,718,494.

Due to 2012’s extraordinary cost totals, this year’s numbers actually came in below the five-year average, which comes in at more than $103 million. The total number of projects, however, was well above the average of 519.

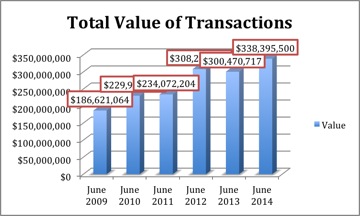

June 2014 saw a total of 1,112 real-estate transactions at a total cost of $338,395,500. If that sounds impressive, it is – it’s about $38 million higher than June 2013 sales and about $150 million higher than 2009 sales. The most expensive sale this month was to the oddly named California corporation Passco Columns DST, which purchased a commercial property at Wakefield Commons for $40,046,500. As there were a number of transactions recorded with a value of zero – many of which appeared to be little more than adjustments to the property’s title records – it’s hard to say what the “cheapest” sale was.

Oddly enough, despite the gap in value, there were 136 more transactions in June of last year. They must have all been outside the Beltline. This year’s sales and total cost numbers were, of course, higher than their respective average. The five-year average number of transactions for June had been 977, while the average total price was $251,865,466.