Friday, December 16, 2016

Brought to you by Rufty-Peedin Design Builders

It’s happening.

Four months after we published “A New Use For The Old Rex,” the State of North Carolina officially issued a Request For Proposals seeking a developer who would purchase and transform the former Rex Hospital site at the intersection of Wade and St. Mary’s into a high-end mixed-use development.

Mike Legeros

The grounds of Old Rex

“It’s a once-in-a-lifetime opportunity,” said Moss Withers, a land broker with NAI Carolantic Realty who attended a pre-bid meeting held at the Old Rex site last week.

“You can’t beat that location,” Withers said.

“Where else in downtown Raleigh are you going to find 15.5 acres [of developable land]?”

Live, Work, Not So Much Play

Although owned by the State, the site’s development potential is controlled by the City of Raleigh, which rezoned it to OX-5 (Office Mixed-Use with a maximum height of five stories) as part of the 2030 Comprehensive Plan, which went into effect earlier this year.

The Old Rex campus was specifically singled out in the City’s Wade-Oberlin Area Plan, where it was described as the only site on Wade Avenue where new retail uses should be allowed. The City hopes to limit that retail use — no one wants to see a Cameron Village style development here — to about five percent of the total square footage.

Withers said he got the impression from the pre-bid meeting that most potential buyers would seek to demolish the property’s existing structures, allowing for the build-out of a maximum of 500,000 square feet of office space and up to 300 apartment units.

Our friend Adam Zaytoun over at Rufty-Peedin Design Builders had offered similar speculation back in June when we first wrote about the impending sale of the property back in July.

“Unless there’s a state tax incentive to keep the old buildings, it wouldn’t make sense for anybody to try and preserve them,” Zaytoun said.

“Obviously, I’d love to see them preserved; but at the end of the day it’ll be up to whoever ends up purchasing the land.”

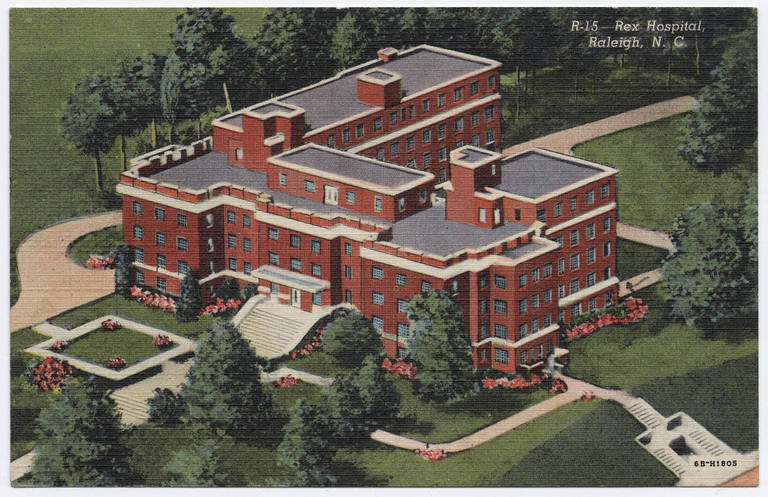

Rex Hospital

An historic photo of the Old Rex Hospital

While some retail use is likely for the site, Withers said it would probably be limited to businesses catering to tenants of the new office towers: a coffee bar, a sandwich shop, etc.

That small percentage of retail is something we imagine most local residents will be quite grateful for.

Retail, not surprisingly, ranks much higher in the “trip generation” category used in traffic studies than office or apartment uses do, so those of you concerned about the impact this development will have on the already-nightmarish Wade Avenue traffic can at least cling to this comforting fact.

Oh, and when we say already-nightmarish: traffic counts as of 2013 were over 29,000 per day on Wade Avenue and 6,300 per day on St. Mary’s. We imagine those numbers have grown significantly in the past three years.

For its part, the State is hoping the future developer will turn the site into “a mixed-use development that creates a sense of place, which is well-integrated with surrounding uses and neighborhoods in Raleigh,” that is of a “high quality design and site layout.”

Sound reasonable.

The RFP also notes that one of the goals of the sale is to deliver “fair market value to the State.”

The Fine Print

It’s that last part that caught our eye.

The Old Rex campus is, of course, a prime piece of very valuable real estate, and the State would be doing a disservice to its taxpayers if they weren’t looking to get the best price possible. It’s probably why they brought on renowned real estate firm Jones Lang LaSalle to help manage the entire process.

The project website is located at www.oldrexhospital.com

But still, one man’s fair is another man’s foul, so we decided to dig into the RFP to see what kind of contingencies the State was seeking to extract from the site’s future owners.

The site is currently occupied — “improved,” to use the official lingo — by about 300,000 square feet of professional office space and a 12,000 square-foot maintenance building. (For a detailed breakdown of the existing buildings, go ahead and skip to the “Fast Facts About Old Rex” at the bottom of this article.)

According to the RFP, the current tenant of said office space, the State Division of Employment Security, will remain on the campus through at least November 9, 2018: a year-and-a-half *after* the State plans to award the contract for purchase.

During that 18-month period, “a triple net lease structure will be negotiated between the selected offeror and the State… The State anticipates, and the offerer should take into account, that the lease arrangement will be at low-cost/no-cost to the State wherein the tenant will be responsible for all operating expenses.”

We’d say that’s more than fair.

The State also has the option to extend that lease agreement for two additional six-month periods to account for any construction or relocation delays, although during that time “The State anticipates that it will pay an increased rent.”

In addition to providing 18 months worth of low-cost/no cost rent to the Division of Employment Security, the chosen developer will also be responsible for an indeterminate amount of site remediation/environmental cleanup.

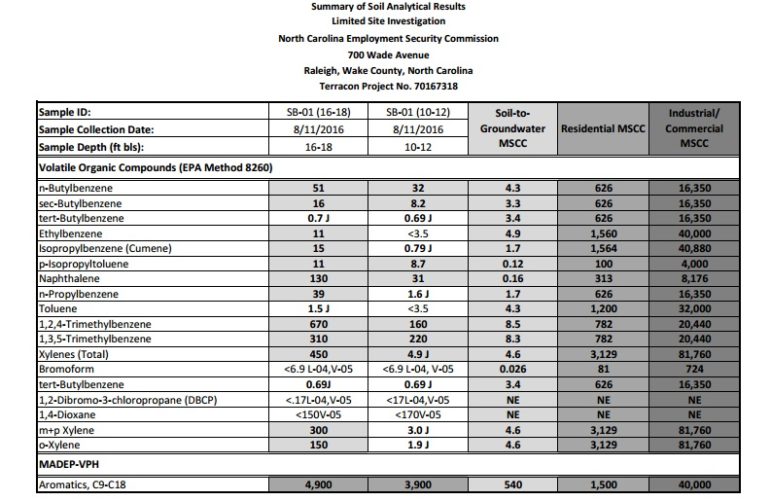

As detailed in a 97-page “Limited” site investigation prepared by Terracon Engineers (we shudder to think of the page count on a “full” site investigation) a gasoline leak from an underground storage tank has contaminated both the soil and groundwater at the site.

As it happens, this contamination precludes any kind of residential redevelopment of the existing buildings — they would need to be demolished in order to perform the remediation work necessary (removal of the soil beneath) to allow for residential development.

Of course, the State expects applicants to factor the potential cost of remediation into their proposals for the property; the offer price, therefore, should include “the value of the land if no environmental remediation were required less estimated cost of remediation resulting in the net offer price. The net offer will enable to the State to make an informed determination with regard to each Proposer’s view on the potential remediation costs.”

Why would the proposer’s views on remediation costs differ? Well, despite the in-depth analysis performed by Terracon, the firm’s report is “intended solely for informational purposes” and “the selected purchaser will be responsible for conducting its own environmental studies.”

Oh. In fact, the RFP goes so far as to note that both the State and Terracon “disclaim all liability for Terracon’s findings.” So naturally, “the purchaser will be responsible for all of its own due diligence during the due diligence period prior to closing.”

The Big Picture

OK: so whoever ends up buying the land is going to have to have some pretty deep pockets in order to absorb 18 months worth of no-cost/low-cost rent and the unknown expense of environmental cleanup. So what?

As the RFP puts it: The Old Rex Hospital Site is ideally situated as a mixed-use infill development with easy access to the commercial corridor throughout the city. There are few, if any, other parcels within the city with similar size, central location and prominence.

Exactly. One other fun fact about the site’s premium hilltop location, care again of Adam Zaytoun with Rufty-Peedin.

“366 feet is the highest point there; that’s higher than downtown,” Zaytoun said.

Google Earth

A Google Earth overview of the site

The elevation level of downtown Raleigh is about 315 feet.

“Whatever’s perched up there is going to have an eagle-eyed view, you’ll be able to see downtown pretty clearly, you’ll be able to see Broughton High,” Zaytoun said.

“It’s a great location.”

Precisely. And in real estate, location is everything.

The property has a current assessed value of nearly $30 million, so it’s not as though this was going to be the kind of project some small-timer would have been able to take on regardless.

In fact, a perusal of the pre-bid sign-in sheet from last week reveals a veritable who’s who of big-league (bigly?) players in the development and real estate brokerage world. Among those in attendance were, of course, NAI Carolantic and our friends over at The Lundy Group, the folks behind the incredible redevelopment of North West Street, along with a number of other companies, whose websites we’ve linked to below: Blue Ridge Realty, Chartwell Property Group, Kotarides Property Management, East-West Partners, Blue Sky Services, Crescent Communities, Regency Centers, Craig Davis Properties, Cole Jenest & Stone, Alliance Group NC, Blue Ridge Realty, Clachan Properties, Lincoln Harris, Foundry Commercial, FD Stonewater, HFF, and Lincoln Property Company.

Speaking of pre-bid attendees, we owe a huge debt of gratitude to Raleigh’s ultimate insider, William N. Finley IV, for putting us in touch with attendee Moss Withers for this article. Withers told us he’d never read the Development Beat, but is a huge fan of ITBInsider, which means the man obviously has excellent taste. Although we’re not sure how he’ll feel about Finley’s planned “Save Old Rex” campaign….

Fast Facts About Old Rex

In case you didn’t click through to our original article, we’ve copy-pasted this list of site/historical details about the Old Rex site.

- Originally built in 1935, completed in 1937, opened May 30, 1937

- Property & Buildings currently have an assessed value of $29,560,987

- Purchased from Rex by the State of North Carolina in 1981 for $2.45 million

- Designed in the Art Deco style by H. Colvin Linthicum, one the first architects in North Carolina to gain his license after passage of the licensing act in 1915. H.C. Linthicum’s certificate was #23

- John Rex, whose will established the Rex Hospital Trust, was a “wealthy landowner, tanner and moneylender” who was described as a “grave, quiet, retiring, modest man.”

- In 1861, the funds in that trust had grown to more than $40,000, which trustees used to purchase Confederate bonds. At the end of the Civil War, the fund was worth less than $1,000. Whoops.

- Wade & St. Mary’s Rex location originally had 174 beds

- When the hospital relocated from Wade to Lake Boone Trail, the patients were transferred in a single day using the help of “the National Guard, 15 area Emergency Medical Services ambulances, and all the Wake County School System’s wheelchair buses.”

- Campus is made up of five separate buildings and seven different wings:

- 1937 “Central” building containing wings A, B and C is five stories tall, has a total gross square footage of 123,933, was acquired for $624,622 and is currently valued at $16,692,335

- 1952 “Laundry/Boiler” building contains wing J, is two stories tall, has a gross square footage of 10,420, was acquired for $16,477 and is currently valued at $300,000

- 1957 building known only as “Wing D” is four stories tall, has a gross square footage of 28,448 was acquired for $122,177 and is currently valued at $0, at least according to State records

- 1957 “Cafeteria” building containing Wing E is two stories tall, has a gross square footage of 11,808, was acquired for $37,776 and like Wing D is currently valued at $0 per State records

- 1970 “Job Service Office” building containing Wing K is one-story, has a gross square footage of 15,525, was acquired for $108,675, and, like the other two before it, allegedly valued at $0.

UNC Wilson Library

A drawing of the original Rex Hospital at Wade and St. Mary’s

Note: When possible, we like to add a photo gallery at the end of our posts. We won’t be doing that here, but as it happens, Mike Legeros, a local author, photographer, historian & fire buff who kindly let us use that photo in the beginning of today’s column, put together a great photo gallery/site tour on Flickr. Check it out here!