Correction: The original version of this article listed the number of homes coming to Raleigh in the next 20 years as 12,000 instead of 120,000.

The Wells Fargo Capital Center downtown sits on 1.2 acres of land, and generates the same amount of tax revenue as 600 single-family homes on a 150-acre subdivision.

So begins Raleigh City Planner Mitchell Silver’s revelations about return on investment (ROI) when it comes to downtown or other urban areas. Silver has delivered these figures in recent months to groups across the U.S.

Joe Szurzewski

Mitchell Silver. Photo by Joe Szurzewski.

Urban ROI may be intuitive for some, but the numbers are surprising to others. Silver, who has given the presentation in more than 100 cities, said the reaction is typically positive.

“People never thought of it that way,” he said. “They thought ‘oh we have a Wal-Mart, great deal, jobs.’ But they never look at the financing of how the deal is actually put together or what’s the long-term cost, what is actual return on investment. So now it’s a growing movement in our profession where people are looking more and more at return on investment.

“This is catching a lot of people by surprise, even though ROI has been there on a number of different projects or investments that people make in real estate,” he said. “People just haven’t applied it to making planning decisions and to me that is really changing the game of how people are beginning to perceive planning for the future.”

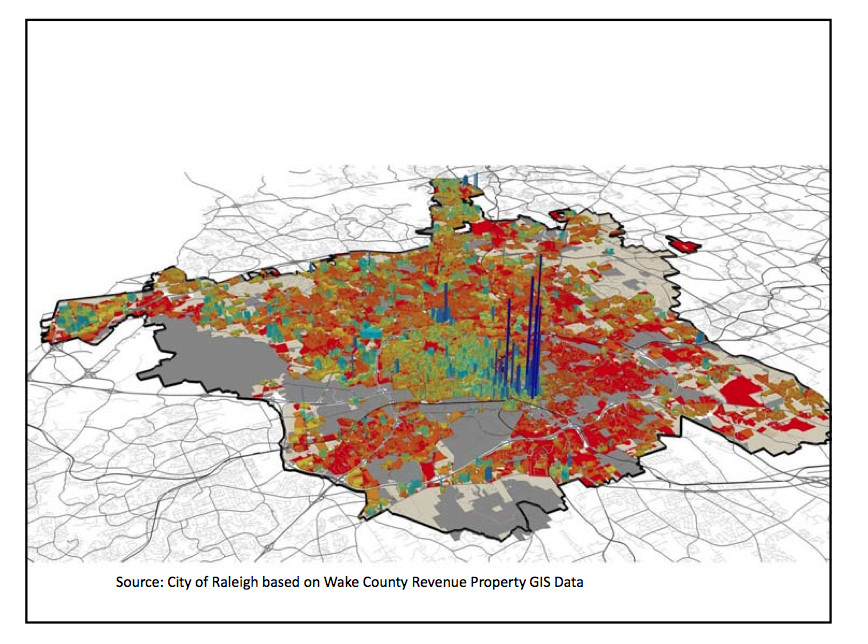

Raleigh’s expansive growth is no secret. According to Silver’s data, Raleigh must figure out where to put 120,000 dwelling units and 170,000 jobs in the next 20 years. That must all squeeze into about 19,000 acres within city limits, or within the other surrounding 20,000 acres.

Those numbers indicate why city planners and officials, including those in Raleigh, must reassess the way they think about growth and buildings, Silver said.

“People just think [planning] is about regulations, it’s about stamping permits, but a lot of it is about keeping a strong tax base and using land more effectively,” he said. “We have 145 square miles in this city and we want to think about using that land very differently. I won’t say highest and best use but using it in such a way that it actually benefits the taxpayers long term and you get a product — be it a building, commercial, residential, whatever it is — that benefits the city.”

-Property taxes account for 29 percent of the city’s budget.

-A downtown high-rise residential on 3-acre site pays off its infrastructure in 3 years. The return on infrastructure investment is 35 percent.

-A suburban multi-family complex on a 30-acre site pays off its infrastructure in 42 years. The return on infrastructure investment is 2 percent.

Source: Public Interest Projects, Inc.

Silver began researching the figures after a renaissance began in downtown Raleigh, eliciting complaints from North Raleigh residents about where the city focuses its spending. A 2006-2010 analysis of spending indicates the city spent more than $381 million outside the Beltline for parks, utilities, streets and stormwater improvements. During that same period, the city spent $108 million inside the Beltline for those items.

“[Downtown] just has a better return on investment because the infrastructure is built,” Silver said. “You don’t need the same level of schools and police facilities and community facilities to support that growth, so when you compare suburban development to downtown development, the ROIs are not even close in comparison. Downtown just is a better return on investment because the infrastructure is already in place.”

When it comes to other improvements, however, downtown does get a bit more attention. That same study indicates the city spent more than $575 million on other general public improvements inside the Beltline, compared to more than $85 million outside the Beltline. However, the downtown spending figure includes $220.3 million for the Raleigh Convention Center, funded by the hotel/motel and Prepared Food and Beverage Tax revenue.

General improvements are things such as fire stations and operations facilities.

Because of such exciting changes downtown, some residents may feel as though downtown and other urban areas of the city get more love. But the truth is, those projects increase tax revenues, Silver said.

“When you do projects downtown, it actually helps keep your taxes low,” he said. “If you don’t support downtown development … actually you’re saying ‘I’ll pay the tax load.’”

One example is City Plaza on Fayetteville Street. The street renovations and plaza together cost $25 million, but provides a $2 billion return on investment, Silver said.

“That investment, $25 million, which was controversial at the time, has now transformed our downtown,” he said.

According to a recent report from the Downtown Raleigh Alliance, 38 new businesses opened in the 110 blocks of downtown in 2012. Although those are private operations, the city’s investment these past few years has helped leverage private investment, said Paul Reimel, economic development manager for the DRA.

“That’s exactly what you want to see is sharing the investment cost because neither public nor private can do it all,” he said.

The nonprofit DRA uses a special tax paid by business owners in the area to support their work, which includes marketing downtown and its events to visitors and non-downtown residents. Reimel said the perception of downtown has changed considerably in the past few years.

“We’re definitely changing,” he said. “Perception certainly is a long-term process but we’re getting some big hits each year with what we’re going.”

Rodney Tiller, manager at Kimbrell’s furniture store on Fayetteville Street, agrees things are changing.

“I’ve been here for 25 years and seen it evolve from one end of the spectrum to the other,” he said.

Paul Connor, part-owner of Lumina, a new men’s clothing store downtown, said his team believes downtown is a great investment for their business.

“We’ve caught a lot of publicity just from being a part of downtown Raleigh,” Connor said. “I feel like we fill a void. There’s a lot of people that want to support retail in downtown Raleigh, and there’s a buzz … Things are happening in a good way.”

-Since 2003, nearly 50 development projects were completed totaling more than $1.3 billion, dramatically changing the face of downtown.

-About $22.3 million in development projects were completed in 2011. Another $445.3 million are currently under construction and $669.5 million are in the planning stages, and could add an additional 1.33 million square feet of mixed use space.

-Although downtown Raleigh occupies less than half a percent of all developable property within the city’s borders, it generates approximately 7.3 percent of the city’s property tax base, even with 30 percent of the central business district being tax exempt.

-Sixty-one percent of the Downtown Raleigh Alliance Downtown Perception Survey respondents want to see more retail in Downtown.

Source: DRA

Silver’s ideas about focused planning line up with the city’s 2030 Comprehensive Plan, which calls for focused growth in eight hubs, which will urbanize as time passes. Developers are on board with the plan, he said, and residents are seeing examples of growth in Cameron Village, along Hillsborough Street and in North Hills.

“Everyone follows this; it makes perfect sense,” he said. “We didn’t just select them randomly, but these are places we felt along the transit line, and along multi-modal corridors, that we knew would urbanize over time.”

Silver, who doesn’t live downtown, said these numbers aren’t his endorsement of urban living for everyone. Smart planners need to look at these figures to keep their cities thriving, he said.

“All we want to do is offer choices,” he said. “Today we don’t have enough urban choices, compact, walkable places that people want to move to, but we certainly have a huge supply of the suburban product. So all we’re trying to do is balance that out.”

Jim Belt of the Downtown Living Advocates agrees downtown residents need more choices. Those who seek a downtown living experience may struggle to find options. Single-family homes abound along the outskirts of downtown, and condos tower in the core, but Belt suggests more walk-up townhouse housing to appeal to another segment.

While Belt agrees downtown naturally has a higher return on investment, he’s not so sure the perception of downtown has fully shifted among area residents who never visit downtown.

“It’s a struggle. Most people who live in Raleigh and who come into downtown Raleigh as residents, or simply visitors, have a very limited urban experience,” he said. “The more we get outside migration from bigger cities … they don’t know what everyone is complaining about. They see Raleigh as ‘This is great. I can see all this potential.’ They’re shocked that parking is so available and it’s free after 5 o’clock.”

He cited the controversy surrounding a five-story development on Hillsborough Street — one of the city’s eight planned urban growth areas.

“What I see happening is people are resisting density in the fringes of downtown,” he said. “If it should be more urban, they should have more density. You’ve got a lot of people coming to Raleigh, where are they going to go? From an economic perspective, it’s really clear. Some don’t want to live in that style. My simplistic view is you can’t have it both ways. Something’s going to give.”

Regardless of Raleigh’s growing pains, Silver is convinced economic development and planning go hand in hand. Any city leader should be thinking about that, he said.

“For years planning was just about visioning, and now planning is about economic development, it’s more about job retention and job creation,” he said. “What I’ve found in my travels is that most planners don’t consider ROI when they’re analyzing projects. Most elected officials don’t consider ROI when they’re considering or approving projects. I think that’s beginning to change. As people look long term on how they’re going to maintain this infrastructure, there are smarter and better ways to invest taxpayers’ money to get a high return on investment but also minimize your maintenance costs down the line.”