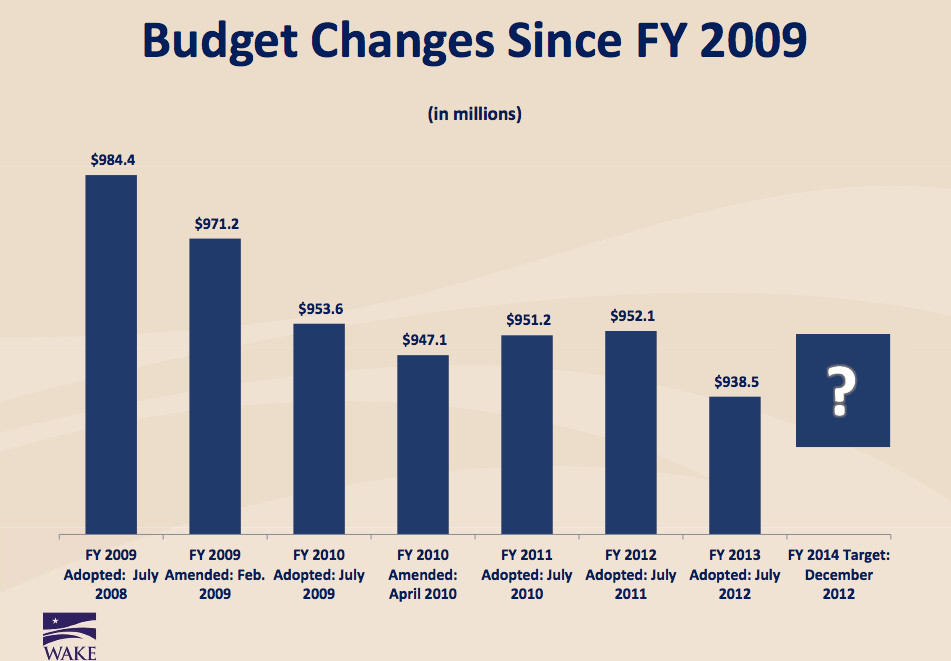

Financially, Wake County is on the upswing, but the budget is still a far cry from life before the recession.

Preliminary budget numbers presented at the Wake County Commissioners retreat Friday show an $18.3 million surplus, but financial staff warned against getting too excited. There continues to be too many unknown numbers, including education expenditures, health care costs, and possible hiring.

Commissioners said they want to keep property taxes at the current rate of 53.4 cents.

Early projections show that “next year will have more revenue than we had this year,” County Manager David Cooke told the Record.

For the first time in four years, Cooke said, department heads were asked to provide a wish list of additional funding instead of a list of where they could make cuts.

Many asked for more staff as well as money to start new initiatives that have been put on the back burner.

Ultimately, Cooke said he’s confident that once all the funding requests are received, the total will be double, if not triple the projected surplus.

This would change in the following year’s budget if county residents approve a school bond expected on the fall 2013 ballot. Residents would see a now-unknown tax increase in June 2014 if they approve the bond.

School Bonds

Under today’s tax rate, Cooke explained the county can take on an additional $100 million in debt until 2018. Anything more than that requires a tax hike.

County Commissioners need to decide if they are going to put a school bond on the ballot this fall to fund capital projects, such as building new schools. The amount of this bond, and the required tax increase, hasn’t been determined.

To get an idea of how much is needed, Cooke said the school district would like to build 26 new schools by 2016.

“That’s nearly $1 billion right there,” he said.

Increasing Revenues

Sales and property tax revenues and building permits are increasing, but numbers are still below where they were prior to the recession.

Sales tax revenue, which took the biggest hit during the economic downturn, has bounced back at about a 3 percent growth for the past few years. Financial staff project similar growth this year.

From fiscal year 2011 to 2012, property tax collections have increased about $10 million, from $635.3 million to $645.7 million. Financial staff is projecting $651.8 million collected in 2013 and estimating $666.3 million in 2014.

Building permit applications continue to be an economic indicator and were at their high of about 11,200 in 2006 and a low of about 3,500 in 2009. About 4,800 permits were filed in 2012.