In an example of what is likely to become an ongoing trend, City Council this week heard a variety of complaints from Raleigh residents on the changes wrought by the Unified Development Ordinance.

William Everett, a resident of the Inverrary subdivision in Northeast Raleigh, told Councilors he is concerned with how the UDO deals with infill, which turns open space into new development.

Everett, whose property borders a newly approved two-lot subdivision, argued that the infill requirements in the UDO are not sufficient to “protect the integrity of existing neighborhoods.”

He asked that the city place a moratorium on issuing permits to new infill subdivisions until revisions are made to the UDO. The city attorney explained the Council would not have the authority to do so, as the permits are entirely legal.

Residents would, however, be able to challenge new plans through the Board of Adjustment, a process that led to the current Oakwood debacle.

Later in the Tuesday Council meeting, during a public hearing for a Hillsborough Street development, David Cox, who previously addressed the Council in early May, once again expressed his concerns over the UDO’s potential downsides, echoing the sentiments of many of those who spoke against the development.

Additional complaints about the UDO are likely to come rolling in as more and more neighborhoods feel the impact of new development, although the biggest issue on the horizon is likely to be the upcoming Remapping Raleigh program.

While this column no longer appears in the Daily Racing Form, gamblers should know the current odds are 1:10 that by summer’s end, Councilors will have heard at least a half-dozen complaints on the program, which will change the zoning for about 32 percent of the city’s land area.

Karen Tam / Raleigh Public Record

Raleigh residents in affected areas are receiving postcards indicating their property will be rezoned under the UDO.

Remapping Raleigh is a crucial part of the UDO, which banished legacy zoning districts from the map. A presentation prepared by the city states that the purpose of the remapping is to fix past problems, such as poorly drawn boundaries or over-zoned neighborhoods. In a surprising twist, the list of problems the program may cause were left out of this presentation.

Happening Now-Ish

The Crabtree Valley Mall will soon be home to the area’s newest Which Wich? The sandwich shop is set to be located in the mall’s new Abbott & Costello wing, also home to the What Hut sunglass store, the Why-Fi electronics outlet, the Where Wear clothier and the Who Knew board and trivia-game specialty shop.

Fayetteville Street will soon be home to yet another high-end cocktail bar in the form of Common 414, which will be located two blocks south of the existing Foundation. While its name sounds more like a computer error than a swank speakeasy, both the web site and the Facebook page for Common 414 are already up and running. The latter describes the bar as one that will offer everything from “easy sipping libations to serious cocktails.”

James Borden / Raleigh Public Record

414 Fayetteville St.

As with the residents of long-term care and senior living facilities, students staying at the University Towers apartments off Hillsborough are offered as part of their rent a complete meal plan with cafeteria-style dining. The dining facility itself, which is open between 10-12 hours each day, is now set to undergo an $820,000 renovation.

James Borden / Raleigh Public Record

A wise man once said, “Right or wrong, it’s very pleasant to break something from time to time.” If this holds true, than these are very pleasant times indeed for Choate Construction and Cecil Holcomb Demolition, whose combined permits for the month represented a total of nearly $1 million in demolition work. More buildings were put on the chopping block last week, including 401 Glenwood, the former home of the North Carolina Department of Insurance, and 616 Oberlin, currently a vacant office building. Both are being torn down to make way for new apartment complexes.

James Borden / Raleigh Public Record

Coming Soon

Including the aforementioned Hillsborough Street project – Z-2-14, a proposed seven-story, 24-unit student housing complex with ground-floor retail – City Councilors this week held public hearings on a total of six rezoning cases.

The hearing for Z-2-14 itself lasted nearly an hour, with a mix of speakers both for and against the new development. Its supporters touted the walkability the complex would offer, and said it would benefit merchants by bringing more students closer to Hillsborough Street. The detractors mostly argued that the building’s seven stories is a violation of the Future Land Use Map, which caps the number allowed at five, although they said they would support the development if it meets this cap.

Councilors voted to allow the case to remain open for an additional two weeks so that the owner can add a condition to the plans.

Councilors also voted to leave open case Z-33-13, which calls for the construction of an AutoZone at 4128-4130 Western Boulevard. A staff report on the project found that it would be inconsistent with the Comprehensive Plan and the Future Land Use Map.

The final case that Councilors left open, Z-11-14, would allow for a 48-unit apartment complex on Tryon Road. A staff report found this development would be consistent with the Future Land Use Map.

Of the three remaining cases, Councilors denied one – Z-5-14, which would have allowed Sanchez Brothers Masonry to use part of their property as a construction yard – and approved two others.

The first approved was Z-3-14, a residential development in North Raleigh, and the second was Z-9-14, a mixed-use development on Friendly Drive off of Hillsborough.

In broader news, while much of the focus on the recent repeal by the state of the business tax imposed by cities has rightly been on the ensuing lost revenue, cities will be affected in another, perhaps subtler way.

It’s important to keep in mind that many municipalities – like Raleigh – used the existing system as a way to incentivize certain businesses, such as an ice cream shop, for which the fees are only $2.50, and keep out others, like Internet gambling parlors, which carry a fee of $3,500 for the first machine and an additional $1,000 per machine.

Without this carrot-and-stick approach, it may become more difficult for Raleigh officials to prevent unpopular on undesirable businesses from cropping up around the city.

By The Numbers

Last month, we looked at the number of construction permits issued and real estate transactions completed in April, and compared the data to what had happened in March.

This time, we’re going to do it a little different and rank the numbers against five — that’s five — years of historical data, ah, ah, ah!

Unfortunately Count von Count was not available to assist in this endeavor, which utilized data made available by both the city of Raleigh and Wake County.

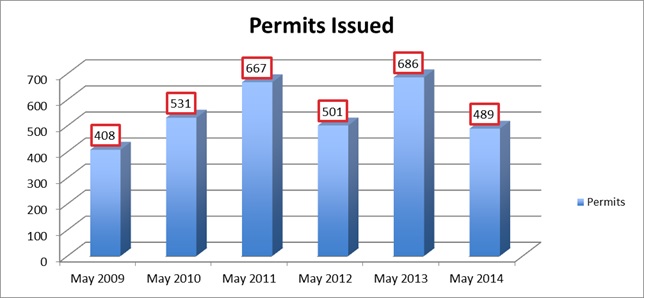

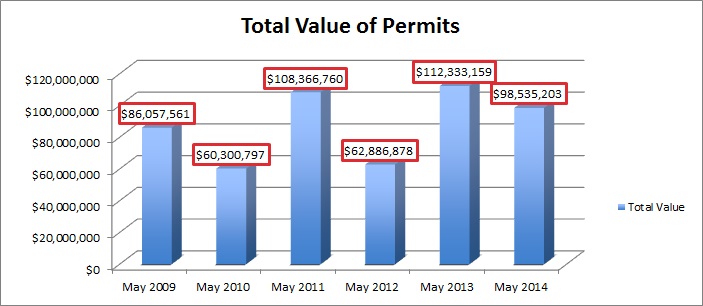

For the month of May, there were 489 residential and non-residential construction permits issued, for a total value of $98,535,203. The most expensive by far of these permits was issued for the Capital Oaks Retirement Community, to be located on Ray Road. The least was for a $144 bathroom remodel for a home in the Pointe at Greystone development.

While the number of permits issued this month is a bit lower than the previous five-year average of 558, the overall value was about $12 million above the previous average of about $86 million.

The charts below illustrate the number of permits and their total values during the years.

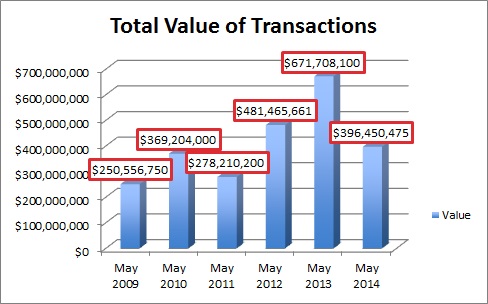

There were a total of 963 residential and non-residential real estate transactions, for a total value of around $396,450,475*. The most expensive purchase was that of the Regency Place Apartments for $145,000,00 by a subsidiary of Tennessee’s Covenant Capital Group. The company bills itself as a real estate private equity firm that redevelops apartment communities.

The numbers for May of this year were lower than the average of the past five years, which saw around 1,370 transactions each month for an average value of around $410 million.

The charts below illustrate the number of permits and their total values over the years.

*One transaction total was recorded in error and the amount was not taken into account here.