Friday, April 10, 2015

As a way of broadening the coverage of the Development Beat, we’re going to take an occasional look at what jobs have recently been awarded or recently started bidding in the public sector.

Not surprisingly, the majority of these public projects are road and pedestrian improvements, although there is a bid out right now for some interior renovations at the Duke Energy Performing Arts Center. Seven contractors have been prequalified to bid on the project. That hitchhiker from Something About Mary would be happy about this. Seven man, that’s the number.

EBX’s parent company is named Resource Environmental Solutions

City Council on Tuesday approved as part of its consent agenda a contract with Environmental Banc & Exchange, LLC (EBX), an RES Company, for $305,690. And if you think the company’s name is long, wait until we try to explain what the contract was for.

In a general sense, the contract was for work related to the Mitchell Mill Road widening project. The road widening job will entail the reconstruction of two storm culverts, which will have an impact on the existing streams.

As a result, the city is required by the federal Clean Water Act to provide “compensatory mitigation.” According to the Environmental Protection Agency, “the fundamental objective of compensatory mitigation is to offset environmental losses resulting from unavoidable impacts to waters.”

Environmental Protection Agency

An example of a mitigation project from the EPA, which is described as: Restored perennial and season marsh and riparian forest at Wildlands Mitigation Bank, Placer County, California

Of course, this doesn’t really explain what EBX will be doing, exactly. Well, they will be creating a “Mitigation Bank” which will serve to offset the impact of the Mitchell Mill Road project. This means, essentially, that the riverbanks will be reconstructed in such a way as to deal with the change in volume or timing of water flow. Well, we think that’s what it is.

Apparently, hiring a firm such as EBX and having them create a mitigation bank is the most preferable way, according to the EPA, of offsetting the environmental impact of new construction in cases such as the Mitchell Mill project. Had the city chosen instead to make a direct payment to the North Carolina Ecosystem Enhancement Program, it would have cost them an additional $12,812.

But we could go on about the varying forms of compensatory mitigation, and as much demand as there is for more shoptalk about environmental protection (See Buzzfeed’s recent “38 Mitigation Bank Restoration Firms You Can Totally Bank On”) we do want to mention one other project before we run out of space here.

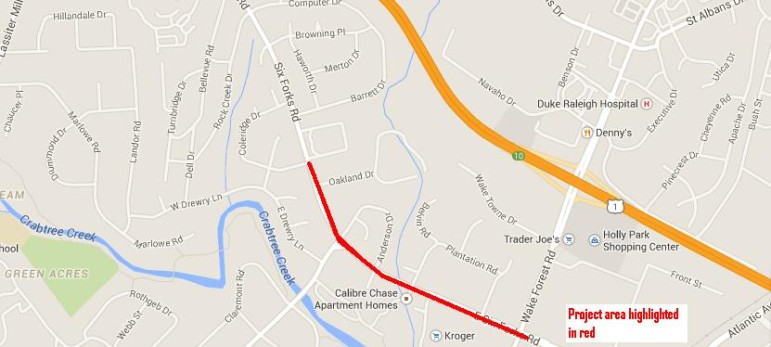

That project is the Six Forks Road Pedestrian Improvements, which will create 1,190 square yards of concrete sidewalk along the north side of Six Forks from Coleridge Drive to Wake Forest Road.

Google Maps, MS Paint

The Sic Forks Road Pedestrian Improvement Project will stretch from Coleridge Drive to Wake Forest Road

It’s out for bid now, with those bids due Thursday, April 16.

Thursday, April 9, 2015

Today on the Development Beat, we take a brief look at the largest and the most exciting renovation permits issued last week.

Wake County

The West Street Warehouse in 2011

A warehouse space located at 801 North West Street in downtown Raleigh was sold in February to a subsidiary of the Investors Management Corporation named Morehead Capital Management. Other companies under the IMC corporate umbrella-ella-ella include Golden Corral and Fleet Feet Sports.

As an investment management firm with a “special focus on small cap companies” — whatever that means — Morehead Capital is definitely less exciting a company than say, Golden Corral or Fleet Feet, but it is the only one with a major renovation job about to take place.

Following the February purchase of that West Street warehouse, Morehead Capital moved quickly to begin renovating the space. Permits totaling more than $1.6 million were issued March 31 to Metrocon for an “addition/change of use” project at the 16,000 square foot space.

But that’s the largest project to receive permits last week. The most exciting is Wicked Taco, a “fresh-Mex” concept chain that originated in Blacksburg, Virginia. Raleigh is apparently going to be their second location. The menu includes everything from barbecue brisket to agua negra citrus-marinated grilled shrimp. The restaurant will be located in the former KFC in the Food Lion shopping center at 3922 Western.

Wake County

The former KFC has seen better days, like this 2002 photo of when it shared a space with A & W

The $342, 117 renovation of the 3,183 square foot space will be handled by Independence Construction. While this reporter mourns the loss of any fast food restaurant, such as the Wendy’s we spoke about earlier this week or the KFC that had to die in order for Wicked Taco to live, it’s nice to see them replaced by what many would consider better alternatives. Chick-fil-A vs. Wendy’s? KFC vs. fresh-Mex? The choice is obvious.

Wednesday, April 8, 2015

Recently in this space, we wrote about the demolition of the former Wendy’s at the Lake Boone Shopping Center, an event that would’ve been more tragic had the space not closed back in 2013. So really it was more of a good riddance.

Wake County

The Lake Boone Wendy’s in its good old days of 2002.

We also reported that a Chick-fil-A would soon be coming to fill the empty space; we just had no idea it would be so soon. The demolition permits were issued February 25; on April 15, permits were issued to Venture Construction for the new restaurant.

The 4,194 structure, listed at a cost of $650,000, will be accompanied by a $23,210 “refuse enclosure,” also built by Venture. The construction industry has a ton of fancy-sounding terms for otherwise non-glamorous projects; stand-alone bathroom facilities, for instance, are often referred to as “comfort stations,” which we think is pretty great.

Although it’s impossible to say how long it will take for the Chick-fil-A to open to the public, Venture Construction is something of a pro when it comes to building out new fast-food restaurants. According to their website, Venture, which has offices in several states and is licensed to work in every continental state save North Dakota, has already built 59 new Chick-Fil-As. They’ve also built 943 new McDonald’s restaurants and 532 new Hardee’s locations. That … is pretty impressive.

Wake County

City of Oaks Cremations

The only other new construction permit issued last week was on a much smaller scale — City of Oaks Cremations will be constructing a new 18×18 storage building. The $15,000 project will be handled by R & L Builders, not to be confused with RLT Associates, who handled a recent demolition job at the Lea Funeral Home in addition to a $365,765 project at City of Oak Cremations last November.

Tuesday, April 7, 2015

Welcome back to Teardown Tuesday here on the Development Beat, where today we look at a few residential demolition projects.

As always, there’s nothing very interesting about a single-family demo project: except to the people that have lived there, these properties don’t hold a particularly unique or memorable spot in the city’s history. But it’s not like we can just make up projects here (let’s just say there’d be a lot more demolition projects on Capital Boulevard if this reporter had his way), so we work with what we’re given.

An old picture of one of the houses being torn down by Tuscany Construction. The mysterious man in the door remains unidentified.

One slightly interesting fact is that two of the residential demolitions this week are being handled by the Tuscany Construction Group, which, according to county real estate records, purchased the properties in question before tearing them down. Oddly enough, one tiny little house was bought by Tuscany in January, received demolition permits March 30, and was then sold to a private citizen April 2. Pretty quick turnaround!

According to the company’s website, they’re not only contractors, but developers as well, responsible for a number of residential communities. Although these two recent demolitions appear to be one-off jobs, it explains why Tuscany would have purchased the land before tearing down the structures which sat upon it.

One not so interesting fact — Tuscany’s address, per their website, is on Six Forks Roads, yet the demolition permits list their address as 125 Glenwood Avenue, the former home of delectable dessert destination Turkish delight’s, which closed more than a year ago. Although their wares were quite delicious, the namesake dish, Turkish delight’s, are probably one of the world’s grossest candies. They are, to the blissfully unaware, a gel square made of starch and sugar, often dusted with a sugar coating. It doesn’t sound bad, but this reporter recalls them tasting something like stale, hardened jelly.

Monday, April 6, 2015

Monday being the drabbest day of the week, we thought it appropriate to run the Development Beat’s dullest recurring feature on one, so get ready for another edition of By The Numbers.

That’s right, it’s time to take a look back over the last month and see how the number and value of real estate transactions and permits issued stack up against the previous five years.

March 2015 was a good month for Raleigh’s real estate market, with a five-year high of 818 transactions, which combined to a five-year high in value as well, at $355,481,000. The five-year averages in these categories had been 563 and $259.2 million.

Wake County

The Summerhill Apartments in December 2001 as they were being built.

The largest transaction last month was for the $39.5 million purchase of the Summerhill Falls Apartments, located north of 540 off Falls of Neuse Road. The new owner is Banner Property Management, based out of Illinois, and which oversees properties in Texas, Kansas, Illinois and Ohio, among others. The previous owner, Capital Properties, is based in New York, and oversees a wide portfolio of retail and residential spaces.

March’s numbers weren’t quite as good for the permits, however. 515 were issued, slightly above the five-year average of 506, but lower than it’s been since 2011. The overall value, which came out to around $84.5 million, was significantly lower than the five-year average, which was $101,763,783. Once again, this was the lowest this number has been since 2011. Hopefully these numbers were just an anomaly, as we’re used to seeing pretty steady growth in all categories.

The largest permit issued in March was for the new Fred Anderson Nissan Dealership out on Glenwood. Choate Construction will be handling the $4,896,157 project.

Bing Maps

Fred Anderson will be building a new Nisaan dealership, which will come with its own carwash