During his last budget presentation to the Raleigh City Council, City Manager Russell Allen Tuesday proposed a spending plan that adds new employees and doesn’t increase taxes, but does increase sewer fees.

The $705.2 million budget is an almost 5 percent increase from the current budget and is the first time that a city budget exceeds $700 million. While the budget doesn’t increase property taxes, it does increase the sewer fees. The average resident will see an increase of $3.74 added to his or her water and sewer bill.

The fee increase will amount to $13.9 million for the public utilities fund. Public utilities is considered an enterprise fund, which means it isn’t subsidized with money from the general operating budget.

The five-year Capital Improvement Program comes in at $664.7 million, with $148.6 million allocated for the next fiscal year.

More than half of the total Capital Improvement funding — $417.3 million — will be used to maintain and improve the city’s water and wastewater infrastructure.

The program also includes funding for transportation projects from a bond that was approved by voters in 2011.

Graphic by City of Raleigh.

Good News for Employees

The budget also includes a 3 percent merit raise for city employees and some new hires. More than 70 positions were eliminated between 2009 and 2012. The proposed budget adds back 40 new positions, most of which are in the Parks and Recreation Department.

The 911 call center will get four new operators and one administrative analyst. Two deputy fire marshals will be hired, but no additional firefighters or police officers will be added under the proposal.

Allen told the Record that although new fire stations are being constructed, it is unlikely that they will be completed during the next fiscal year. Also, it is possible that the stations could be staffed using existing firefighters.

About $3 million will go toward upgrading protective breathing equipment for firefighters.

As for police officers, “Given some of the other public safety investments and limited budget resources and the high cost of a police officer, we just could not work any meaningful number of positions in the budget,” Allen wrote in a follow-up email to the Record. “I tried to focus more on pay and benefits.”

Increasing Revenues

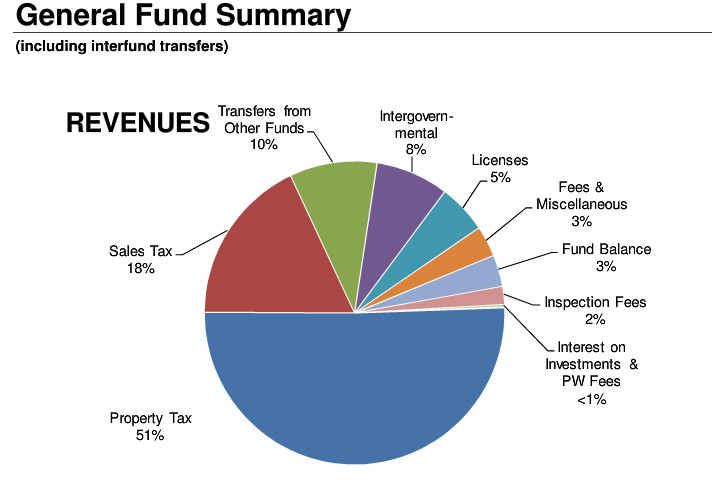

The city’s revenue comes mainly from property taxes, water and sewer charges, interests and fees and sales tax.

Property tax revenue is projected to increase almost 2 percent and vehicle taxes projected at 8 percent. Sales taxes are also on the way up and staff projected a revenue increase of $2.9 million from the current budget.

Allen said 16 major private projects went into the ground this year, totaling about $646 million in investment. About $140 million of that was in the downtown area.

Deferred Maintenance Coming Due

The city has been playing catch up with deferred maintenance since the economy began to turn around in fiscal year 2012. The budget includes $24.1 million for equipment replacement with about 42 percent of those costs — $10.1 million — going toward solid waste vehicles and equipment.

What the budget doesn’t fully cover is the maintenance of city infrastructure and more than $164 million in unfunded non-transportation projects.

“We don’t have the funds to do all the things that are needed,” Allen told the Council.

Public Input

Residents can get a copy of the proposed budget in the City Clerk’s office, or it can be found online.

A public hearing on the budget will take place at 7 p.m. June 4 at City Hall.

The Council will have weekly budget work sessions throughout the month of June until the budget is adopted. The budget must be adopted by the start of the next fiscal year July 1.